When you look back at how much you’ve added to savings in the last month, is it on track with what you’d like, in need of some attention or has building your savings just not happened in recent months (or years)?

No matter where your savings habits have been in the past, today is the day you can change it all. It’s not too late to start setting aside money. Read on for a few tips to set your savings goals in motion, and potentially even save $1,000 in three months.

Set up automatic transfers.

Did you know you can log in to online banking right now and set up automatic transfers to happen at a frequency you choose? If you have a particular goal in mind that you’d like to save for, such as buying a new computer, you can also open a Name Your Savings account and have funds automatically deposited.

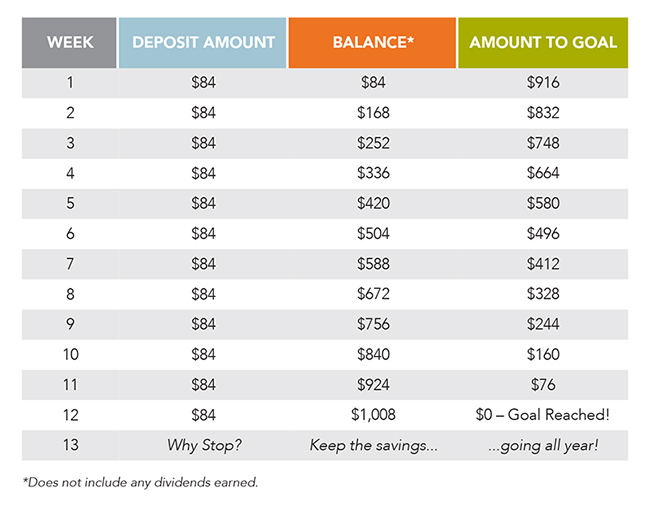

To save $1,000 in three months, you will need to set aside $84 a week (or $12 a day) for 12 weeks. Here’s what that would look like:

Set your goal and stick to it.

If you aren’t setting aside any money at the moment, the thought of putting $84 a week into savings might sound like a stretch. Here are some tips for making it happen:

- DON’T keep it a secret. Having your goal written down makes it real, and telling others about your goal helps hold you accountable and keeps the enthusiasm up for when it gets tough to reach your goal.

- Stick to a budget. If you haven’t started budgeting yet, now is the time. Review your income and expenses and include building your savings as an “expense” you NEED to pay each month. The phrase, “pay yourself first” means you should set money aside for savings just like you do other bills. Then, after all bills and expenses are paid, use the rest of the money for additional savings, entertainment or other wants.

- Get serious about your belongings. Take a look around each room in your house. What’s in it that shouldn’t be? What’s in it that you don’t need anymore? Go through each space in your home and identify things you don’t need any more and consider selling things online to help ensure you have the $84 each week to save $1,000 in three months.

If you’re not quite ready to set aside $84 each week, try setting aside $5 a week and slowly increasing that number as you are able. Or, add a few cents to your savings account each time you make a purchase with your debit card when you add Verve’s RoundUp to your account.

Want more details on how to build your savings? Check out our monthly blog posts for more.

Federally Insured by NCUA |

Federally Insured by NCUA |  Equal Housing Opportunity |

Equal Housing Opportunity |