Budgeting 101: know what you make and keep your spending within those limits. Sounds simple, right? So simple that you really don’t need to write it down and keep track of your expenses—well, not quite.

When it comes to finances, we know that just the thought of making changes, or even organizing your bills, can be overwhelming. That’s why we’ve created a step-by-step guide to help our new-to-budgeting friends get started. (P.S. This beginners budgeting guide is also a great opportunity for experienced budgeters to take a fresh look at their budget.)

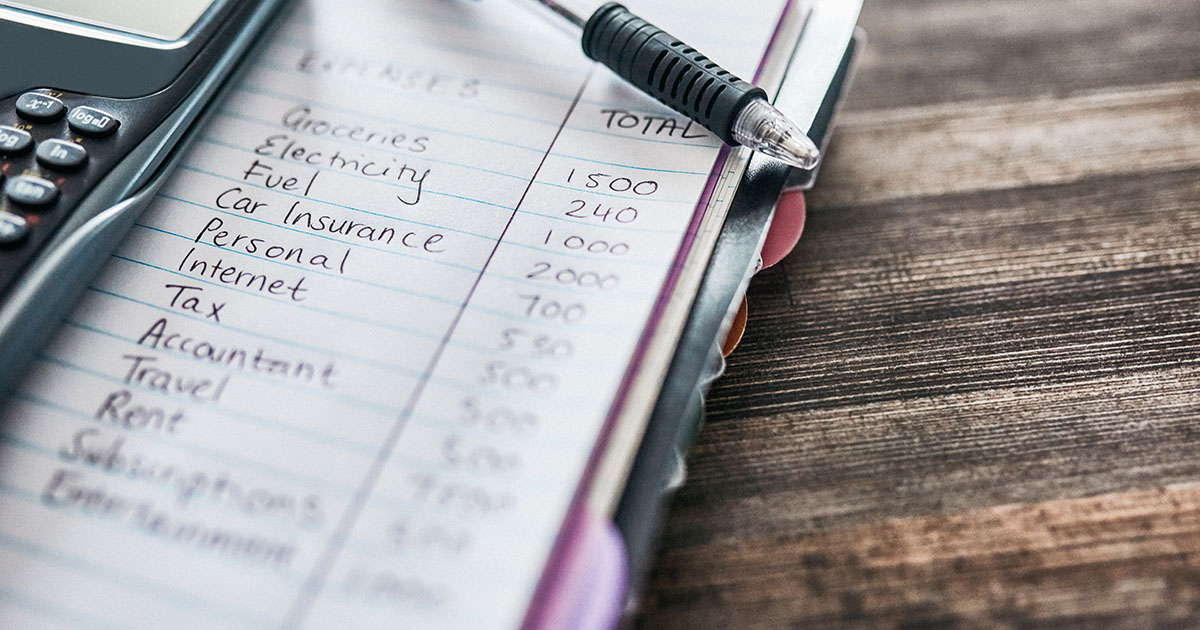

- Gather all of your financial documents and logins. Before you start listing out your expenses, take some time to collect your most recent bills, receipts, emails, bank statements, paystubs and any other financial documents that might help you get a full picture of your expenses. Don’t forget to gather documentation on your weekly, monthly, quarterly and more sporadic expenses, such as medical bills, car insurance and taxes.

- Start sorting your expenses and income by frequency. Create a pile (or spreadsheet column) for each of the following expense types: weekly, monthly, quarterly, annual and one-off expenses. Then do the same with your income. Be sure to list the dates the expenses occur, or the day of the week (i.e. 15th of every month, every Wednesday, etc.)

- Now you can start filling out a budget worksheet. Whether you choose to use an online tool or app, or want to try out a budget worksheet like this one, it’s important to get your expenses and income listed out on paper. Fill out two: one for your current spending habits and one for your goal budget. This will show you where you need to make changes in your spending habits.

- Highlight the areas that surprised you. We all have a weakness when it comes to our budgets. For some, it’s limited-time sales emails and for others it’s the oh-so-delicious-looking billboards, or maybe even your TV or online streaming services. But writing it all down may open your eyes to expenses (or the size of the expenses) that may not have been on your radar.

- Make some calls and update your subscriptions. After you identified your current spending habits, outlined your goal budget and highlighted some areas you can trim expenses, it’s time to take action! If you noticed three TV streaming subscriptions, pick your favorite and cancel the other two. Or if you pay for internet, TV and phone but really only need internet, call your service provider to let them know you’d like to switch to an internet-only plan. Sometimes just calling your service or subscription provider can lead to a better deal.

- Consolidate your debt. If you have an auto loan payment and pay the minimum on one (or more) credit card balances, moving your debt to one credit card or loan may help you lower your monthly payments AND reduce the amount you pay over time (if you consolidate to a lower interest rate). As a bonus, you’ll only have one monthly payment due date to remember!

- Research your options and change things up. Did you know that many auto insurance companies give you a discount for paying your bill annually or semi-annually instead of monthly? While dropping that chunk of change may not be an option this year, try setting aside a little bit each month in a Name Your Saving account so you can get a reduced rate next year. Take some time to review each of your expenses to see if switching providers—or researching options on their website—may lower your monthly bills for things like cellphone service, trips to the mechanic or the hairstylist.

- Plan for fun. Are you a road trip lover? Need a little retail therapy now and then? Or do you splurge on something else entirely? Work it into your budget! Planning for a little fun each month is not only good for your mental health, but it will also help you stay on budget in the long run.

- Find an accountability partner. Whether it’s your spouse, sibling, best friend or neighbor, find someone who’s interested in fine tuning their budget and help each other stay on track. Plan monthly check-ins to review your budgets (you don’t need to share the nitty gritty details of your income and expenses) and areas of concern and then challenge each other to make one improvement each month.

Looking for more budgeting tips? Check out our monthly budget tips for more resources.

Federally Insured by NCUA |

Federally Insured by NCUA |  Equal Housing Opportunity |

Equal Housing Opportunity |