You’re driving along and things are going just fine. The further you go, the more woods and wilderness you soak in and the fewer houses, gas stations and people you see. Ah, so peaceful, until you see your phone no longer has service and your map app or GPS is searching for a connection. You are lost. Now what?

Sometimes setting a budget can feel the same way. You’ve got a destination in mind; you start plugging along until suddenly you hit a literal bump in the road and need to foot the bill for an unexpected car repair.

Whether it’s an unplanned trip to the mechanic or another one of life’s surprises, here are a few tips to find your way and get back on track with your budget.

Finding your way back

- Hit the brakes. One of the most detrimental things you can do if you get lost is to keep going. Quit moving and stay calm. The more you move, the further off track you could get (both literally and in your budget).

- Breathe and think. We know, getting lost can be stressful and the last thing you want someone doing is telling you to breathe, but we’ve gotta do it. Take time to evaluate how you got here in the first place. You were walking on the trail and then saw the lake, so you ventured down a rabbit trail (or you were staying within budget on your food purchases, but then you planned a trip to the beach and bought enough snacks to feed a small army).

- Plan your next steps. Now that you’ve taken the time to observe how you got where you are, determine the best way to move forward. Is it to retrace your steps, or take a quick detour to get you back on a marked trail or major highway? The same is true for your finances. If you started shopping online during the onset of the pandemic and your monthly grocery bill has increased exponentially, take a look at what caused that. Maybe you’ve been hit by the “others also liked this” section, or you checked your pantry and realized you are stocked up on pasta for the next 10 years. Look at your monthly expenses for the last three months to see areas where you have gotten off track and make note of ways to get yourself back on the planned route.

Avoid getting lost again

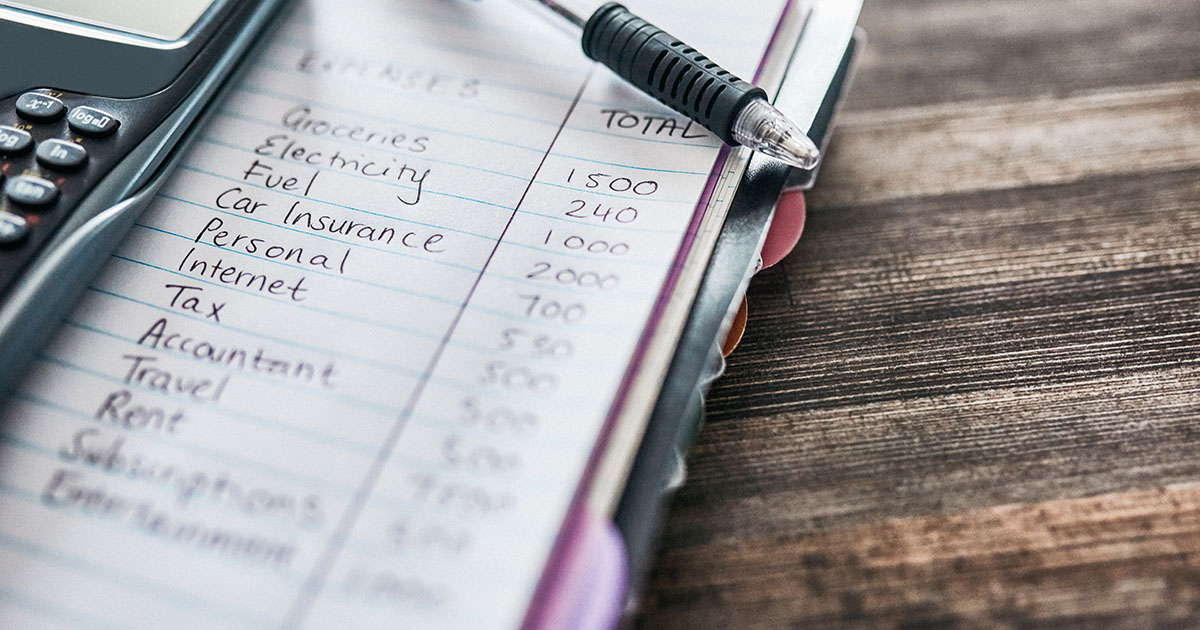

- Study a map. Look at where you are going, where you are and the journey you need to take. Identify the geography along the way and any landmarks that can help you find your way. Write down simple directions so you always have a backup plan if your GPS goes out. As a bonus, even if you lose the written directions, the act of writing the directions down helps you remember the steps. The same is true with your budget—write down what you need to do to get to your ideal budget and stick to the plan.

- Be aware of your surroundings, but don’t get sucked in. Have you seen horse-drawn carriages and noticed many of the horses are wearing blinders? These little squares positioned carefully near the back side of a horse’s eyes are meant to help the horses stay focused on the route in front of them and stop them from looking back or to the side and getting distracted (or worse, panicked) by what they see. The same concept can be applied to your finances. It can be easy to get lured in by a pop-up ad about something you were just thinking about (how do they do that anyway?!), tempted by the billboard advertising a mouthwatering new beverage or panicked by the latest news story (wildfires, hurricanes, viruses, yikes!). While there’s no need to hide under the covers, it is important to stay grounded in your plan and avoid getting sucked into distractions.

- Know which way is north. If you typically give directions by telling someone to turn left by the McDonald’s, and hearing north, south, west and east causes your heart to beat a little faster, we’re here to give you a few tricks to use. If you’re walking in the woods, find a stick and mark the tip of the shadow in the dirt. In 10-15 minutes, mark the tip of the shadow again and the line you draw goes east to west. In the city, look for street name markers (First Ave N) to show you which way you are going. With your finances, knowing which direction to go can be tough to find on your own. Don’t be shy—give a Verve team member a call or schedule an online appointment and we can help you get back on track.

Looking for more tips to help you get your budget back on track? Check out our monthly budget tips for more resources.

Federally Insured by NCUA |

Federally Insured by NCUA |  Equal Housing Opportunity |

Equal Housing Opportunity |